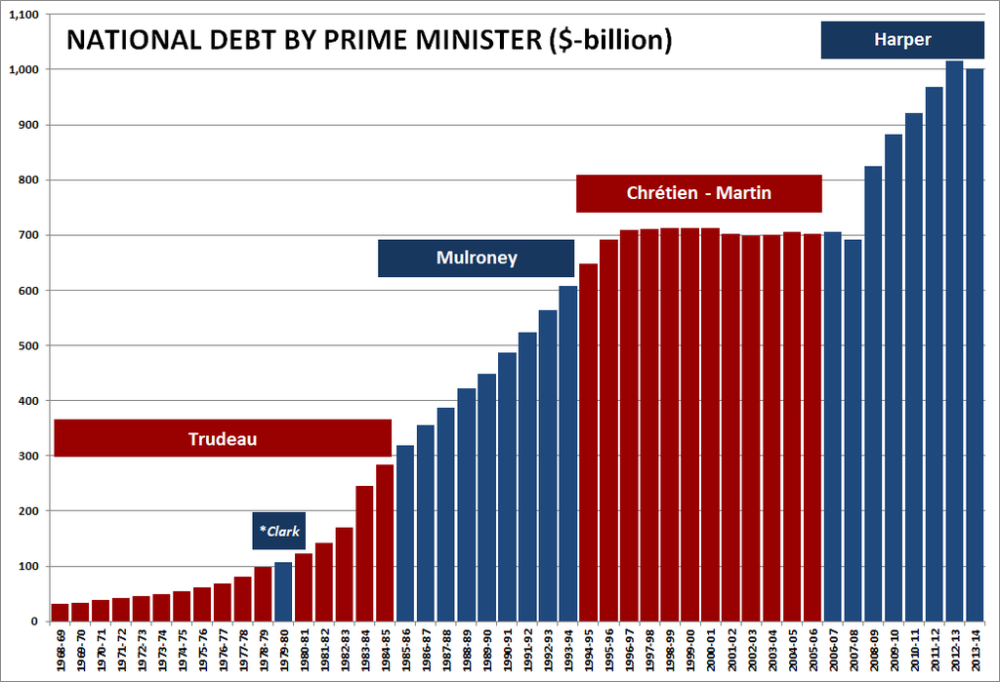

I’m watching Canadian liberals and leftists on #cdnpoli on Twitter fall for the same thing their counterparts in the US have been duped by for 40 years: calling out conservative claims of superior fiscal management, by which they mean deficit reductions.

See: (source: twitter)

(source: twitter)

Here’s the thing: conservatives don’t care that your Prime Minister/President actually achieved the deficit reductions theirs only talked about. It’s factually true, but that’s not the point.

Here’s why: when conservative governments deficit spend, they give out tax cuts to the people who voted for them. To be only slightly reductive, that’s the main reason people vote for conservatives.

Here’s the conservative playbook.

Liberal government in power

- Complain about unsustainability of national debt

- Complain about the federal budget deficit

- Complain about the tax burden on “deserving” people

Conservative government in power

- Claim we can’t afford spending increases

- But here, have some tax cuts!

- National debt? What’s that?

It’s not about economics, it’s about ideology and electoral politics. And it’s a merry old political strategy called the Two Santa Claus Theory.

In short: Republicans realized in the 70’s that their embrace of supply-side economics limited their electoral options a great deal. Democrats were, in their opinion, free to buy the electorate with their social programs. But since the GOP already believed wealth would trickle down from the rich to the poor, tax cuts would be the gift they bestowed on the nation, matching the Democratic Santa with the Republican Santa. And if they could convince everyone about the dangers of national debt, Democrats would have to become anti-Santas themselves whenever they raised taxes to fund welfare programs.

The reason this has worked shockingly well is that while trickle-down economics doesn’t work, they’ve effectively shackled Democratic and Liberal governments from bringing the economy to even close to an optimal performance.

It’s a strategy built on foundations of neoclassical economics, and it relies on liberals and progressives to also buy into the notion that deficits and national debt are bad, at least in the long run. This is widely believed, but is… well, wrong.

National debt is just all the money federal government has spent into the economy that it hasn’t taxed back. It never has to be “paid back”.

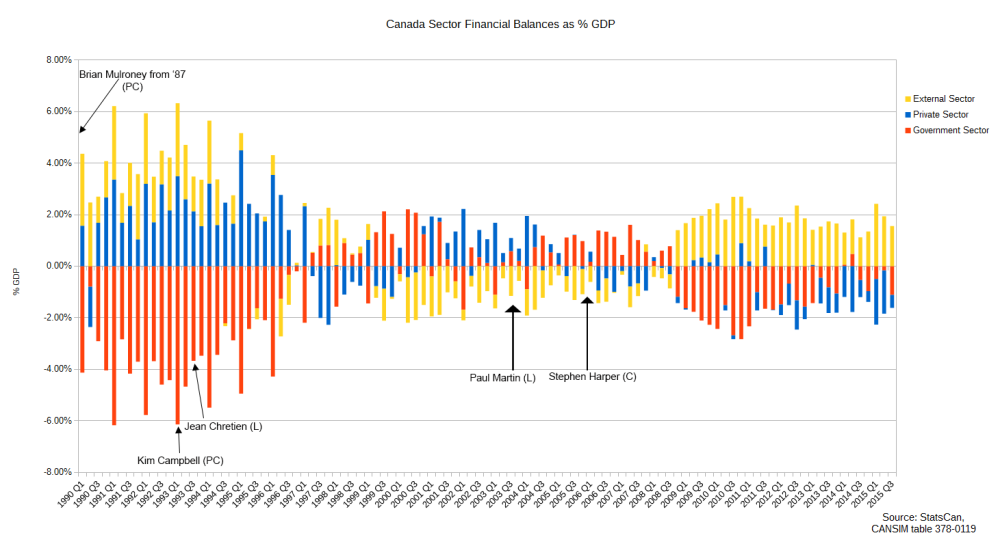

Federal budget deficit injects money into the private economy, surplus destroys it. In this three-sector chart of financial flows we have the domestic private sector in blue, public sector in red, and the rest of the world in yellow.

There are nuances to both of these, most obviously posed by the external sector, but those statements in bold are a good starting point to understanding them. Most economists apparently don’t.

Canadian or US federal governments can never run out of money they themselves are the sole issuers of. They can never default on debts denominated in their own currency unless they decide to. Again, there are nuances, but that has to be the starting point. Greece can run out of Euros, but Canada can’t run out of Canadian Dollars.

Inflation is a real restraint, but orthodox economics is wrong about that too. It’s about availability of real resources: demand outstripping supply of goods and services, not about the quantity of money in the economy, and both countries have plenty of real resources for everyone.

Truth is: government could eliminate homelessness, unemployment and extreme poverty with targeted programs, e.g. job guarantee.

Federal government can empower communities, local governments, non-profits and social enterprises to hire everyone affected by involuntary unemployment, at a living wage. Direct, grass-roots, bottom-up job creation funded by the federal government. This will be socially valuable work and can actually eliminate the devastating effects on society and individuals caused by and exacerbated by unemployment, unlike lesser initiatives only aimed at easing unemployment.

Private business would also benefit from the increased aggregate demand, though some may be kicking and screaming about it. It would hardly be a “communist takeover” of the economy. Capitalism remains intact, it will just stop keeping the government from fulfilling its public purpose.

It would still be transformational, especially for the people currently sacrificed for the sake of “economic stability” for the rest.

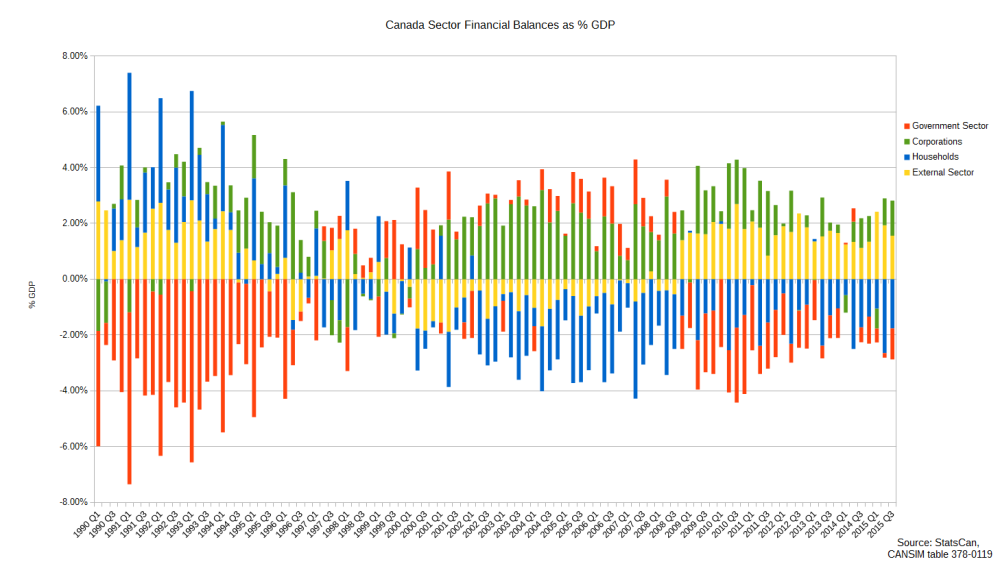

How’s that working, by the way? Let’s take that previous chart and break down pvt sector further and see who’s taking on debt and who’s accumulating wealth. Spoilers: current Canadian economy is built on record high household debt. You think that’s sustainable? You think warnings of a housing market crash are exaggerated? Well, consider this a prediction.

Bottom line: focusing on debt to GDP ratios or the raw size of the deficit is arbitrary and irrelevant. “Sound finance” has no basis in reality, only in ideology. What we need is functional finance that can actually get us to full employment. It’s not about the size of the budget deficit, it’s about who that money will go to.

I recommend the Modern Money Theory Primer blogs at neweconomicperspectives.org to recalibrate your understanding of money, debt, economics and the role of the government, and what is possible under the current system. No violent revolutions or lawsuits against the Bank of Canada are required.